We’ve built our legacy by helping secure investors’ financial futures.

Value Line Funds Lineup

| Fund | Category | Factsheet | Manager Q&A |

|---|---|---|---|

| Small Cap Opportunities Fund | Equity Funds | December | Q4 2025 |

| Mid Cap Focused Fund | Equity Funds | December | Q4 2025 |

| Larger Companies Focused Fund | Equity Funds | December | Q4 2025 |

| Select Growth Fund | Equity Funds | December | Q4 2025 |

| Asset Allocation Fund | Hybrid Funds | December | Q4 2025 |

| Capital Appreciation Fund | Hybrid Funds | December | Q4 2025 |

For Financial Advisors

This information is solely for registered advisors.

News & Updates

Commentary

The Value Line Funds Family

With a history that traces its roots back to 1950, the Value Line Funds have evolved into a diversified family of mutual funds with a wide range of investment objectives. The Value Line Funds include equity and hybrid funds and are designed to help investors meet their long-term investment goals.

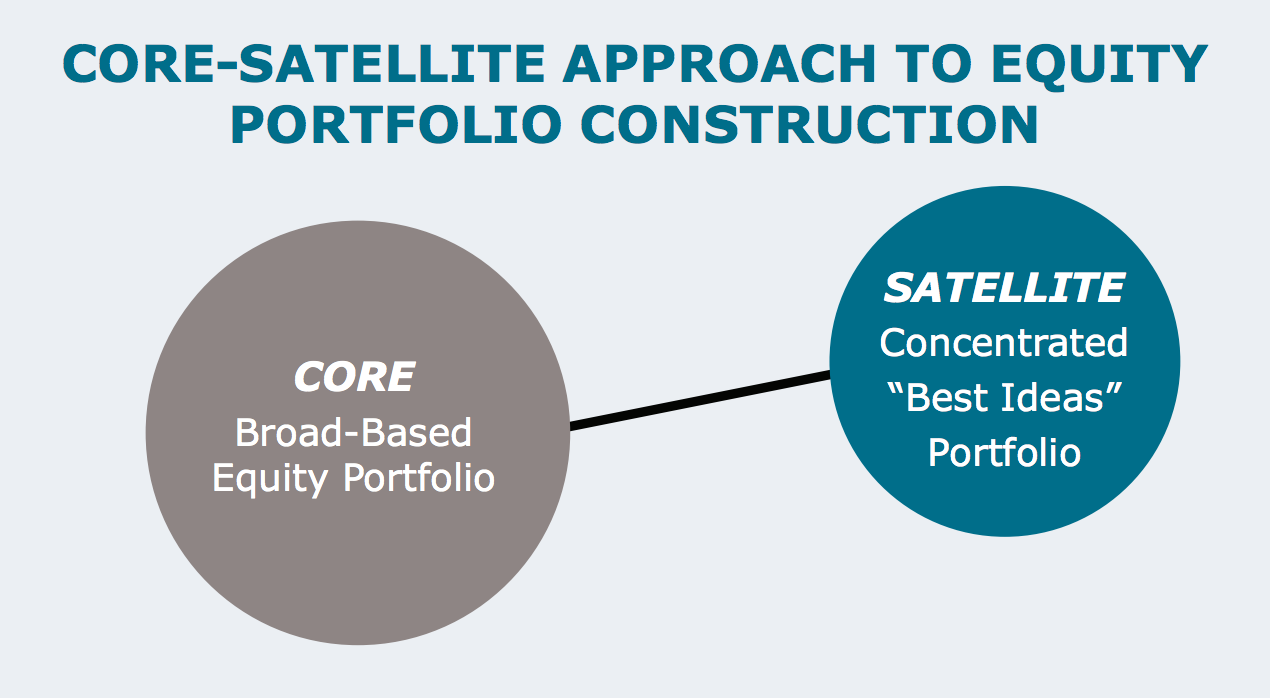

A Focused Approach

A concentrated equity portfolio is distinct from other mutual funds in that it is generally focused on a portfolio manager's "best ideas."

For example, a concentrated fund may have 2% each of 50 stocks versus a more diluted fund with 0.5% each of 200 stocks.